Old is Gold: Back to the Old with Astra Worldwide

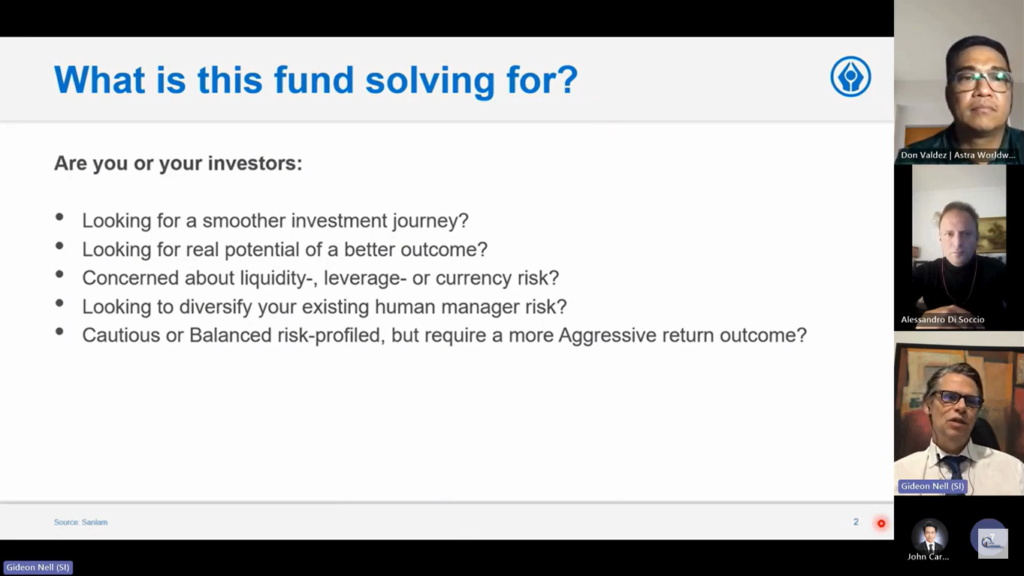

Last year, Astra Worldwide advised clients to invest in bonds due to favorable market conditions. Expected interest rate cuts created an opportunity for bonds, as lower rates typically increase bond prices. In the second half of 2024, inflation further fell, leading to rate cuts globally. As a result, bond investments performed well, and our clients benefited. Now with U.S. […]

Old is Gold: Back to the Old with Astra Worldwide Read More »